FUND OF FUNDS PROGRAM

An exclusive opportunity for experienced fund managers and high-income professionals with strong networks to partner with a quality multifamily operator.

Watch The Webinar Replay

WELCOME TO THE FUND OF FUNDS PROGRAM!

If you’re a Fund Manager who is:

Able to raise at least $500,000.

Looking to partner with a high-quality multifamily operator.

Committed to scaling their funds.

Then you’re in the right place!

We're dedicated to helping fund managers launch and scale, offering full-service setup, ongoing support, and assistance in capital raising to exceed your goals.

Why Partner with Nighthawk Equity?

EXPERIENCE

Our partners have a combined 34 years of multifamily operational experience.

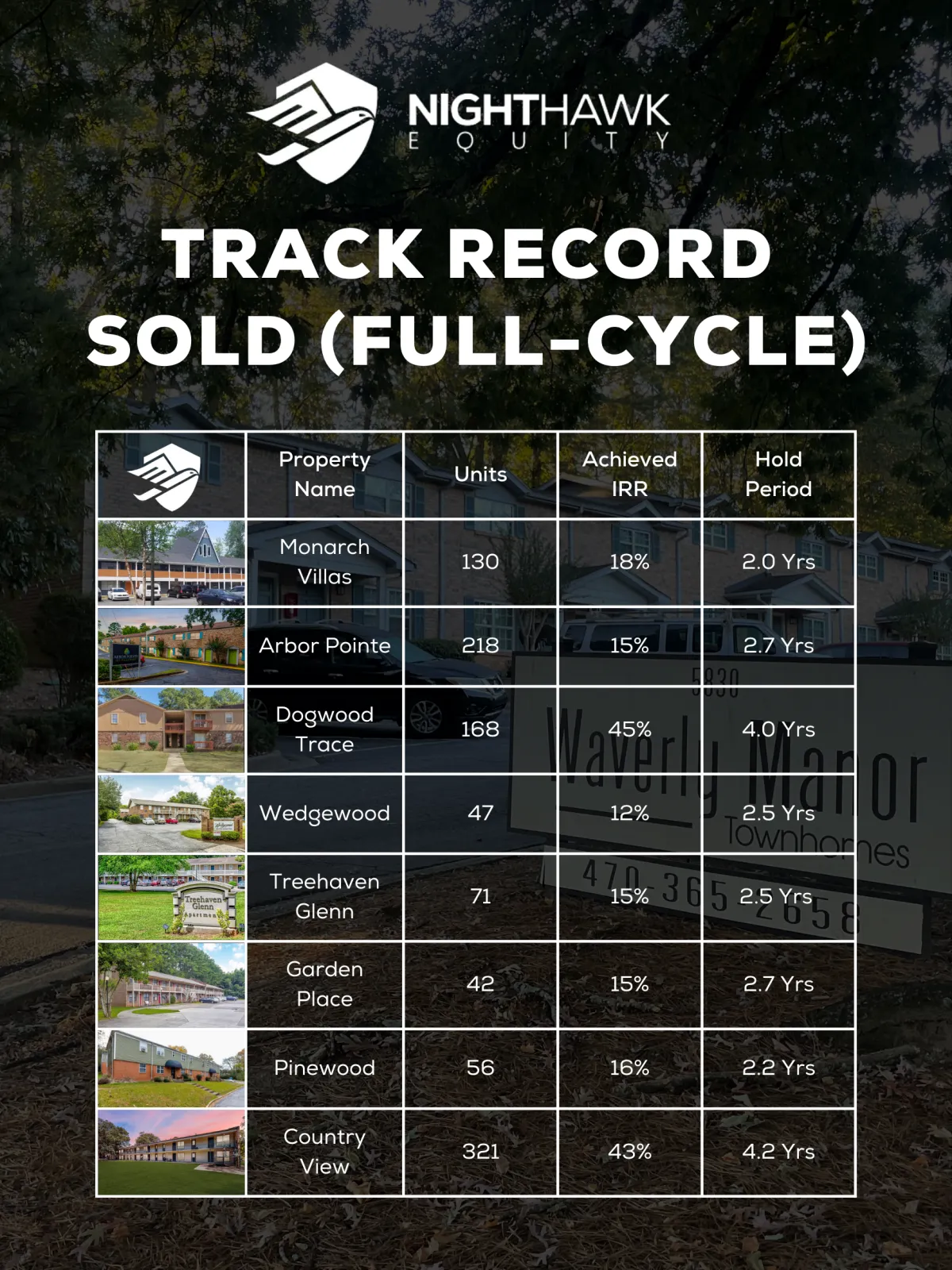

TRACK RECORD

We've acquired over 3,000 units since 2017 with many successful exits along the way.

CAPITAL RAISING

We've raised over $95 million from 500+ investors.

OPERATIONS

We have in house asset management, construction oversight, and investor support.

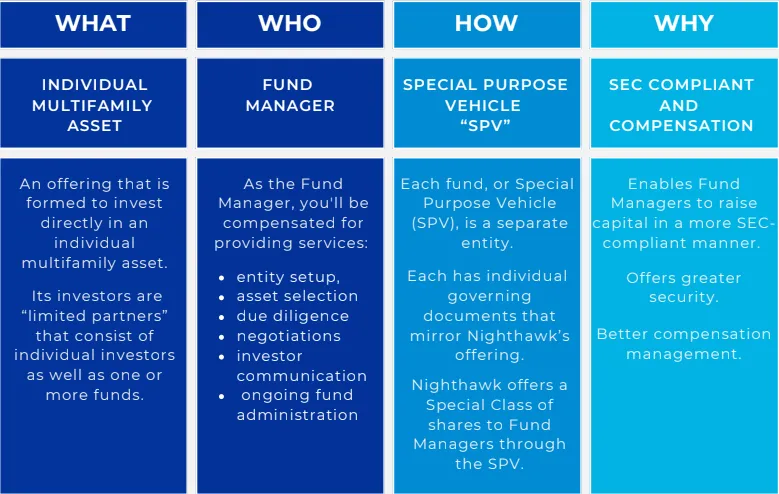

WHAT IS A “FUND OF FUNDS” (FOF)?

HOW OUR FUND OF FUNDS WORKS

Customized for Fund Managers

Create a Special Purpose Vehicle (SPV) tailored to your needs, offering better terms than typical syndications.

Secure and Compliant

A structured and regulated environment

ensures safety for both fund managers and investors.

Enhanced Compensation

Benefit from a preferred return and an attractive investor/sponsor split, ensuring competitive earnings.

How Our Fund of Funds Works

Customized for Fund Managers

Create a Special Purpose Vehicle (SPV) tailored to your needs, offering better terms than typical syndications.

Secure and Compliant

A structured and regulated environment ensures safety for both fund managers and investors.

Enhanced Compensation

Benefit from a preferred return and an attractive investor/sponsor split, ensuring competitive earnings.

Meet Our Leadership Team

At Nighthawk Equity, our leaders bring a wealth of knowledge and expertise to guide our fund of funds mangers to success. Get to know the dedicated principals driving Nighthawk's operations.

Garrett Lynch

Garrett Lynch heads up our acquisitions team and manages all sourcing, underwriting, due diligence, and closing.

In 2013 he co-founded a firm that grew from 0 to 3,400 units and a management company with 125 employees; he successfully exited that venture and teamed up with Nighthawk Equity.

Garrett graduated from Illinois State University with a degree in marketing, sales, organizational leadership and is a licensed real estate agent in the state of Arizona.

Michael Blank

Michael Blank is the leading authority on apartment building investing and the founder of Nighthawk Equity.

In addition to his own investing activities, he’s helped students purchase over 41,000 units valued at over $1.5B through his mentoring

programs.

He’s the author of the best-selling book “Financial Freedom With Real Estate Investing” and the host of the popular “Apartment Building Investing” podcast

Drew Kniffin

Andrew (Drew) manages all aspects of Nighthawk’s growing portfolio, with about 3,000 units under management valued at $360M.

Before joining Nighthawk, he accumulated a portfolio of 400 residential units.

Andrew has a corporate finance and real estate investing career that spans a decade. After finishing graduate school (JD/MBA), Andrew was an investment banker providing corporate valuation analysis.

Garrett Lynch

Garrett Lynch heads up our acquisitions team and manages all sourcing, underwriting, due diligence, and closing.

In 2013 he co-founded a firm that grew from 0 to 3,400 units and a management company with 125 employees; he successfully exited that venture and teamed up with Nighthawk Equity.

Garrett graduated from Illinois State University with a degree in marketing, sales, organizational leadership and is a licensed real estate agent in the state of Arizona.

Michael Blank

Michael Blank is the leading authority on apartment building investing and the founder of Nighthawk Equity.

In addition to his own investing activities, he’s helped students purchase over 41,000 units valued at over $1.5B through his mentoring

programs.

He’s the author of the best-selling book “Financial Freedom With Real Estate Investing” and the host of the popular “Apartment Building Investing” podcast

Drew Kniffin

Andrew (Drew) manages all aspects of Nighthawk’s growing portfolio, with about 3,000 units under management valued at $360M.

Before joining Nighthawk, he accumulated a portfolio of 400 residential units.

Andrew has a corporate finance and real estate investing career that spans a decade. After finishing graduate school (JD/MBA), Andrew was an investment banker providing corporate valuation analysis.

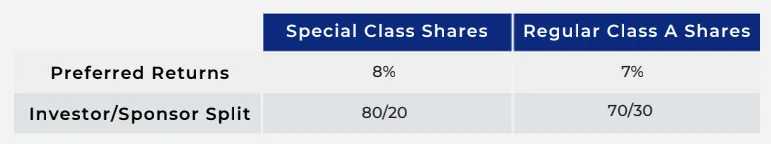

Partnership Terms and Economics

A $500,000 minimum fund investment is required to receive enhanced economics. The Fund Manager will create a Special Purpose Vehicle (SPV) to invest in a special class of shares which will offer better terms than for individuals who invest in regular Class A shares. The Special Class Shares are designed to yield proportionally higher returns compared to the Regular Class A Shares.

Please see the example (for informational purposes only).

Recommended Fund Structure

Fund Managers can structure their fund’s economics freely, with the recommended terms offering LPs comparable or better returns to direct investment while allowing strong compensation for the Manager.

Due Diligence Fee: Fund Manager charges the fund a 2% due diligence fee paid at closing ($20k fee if raising $1,000,000).

Fund Management Fee: Fund Manager charges the fund a 0.5% fund management fee to be paid on an annual basis (e.g. $5,000 to be paid annually for a $1,000,000 fund).

Fund Setup & Admin Fee: Fund Manager charges the fund for set up and

ongoing administration costs ($5,000 upfront and $2,000/year, assuming the fund has 10 investors or less).

Preferred Return & Profits: Fund Manager offers LP shares at a 6% preferred return and 70/30 split. The fund manager’s compensation is derived from the enhanced economics from the special class shares.

With this recommended Fund structure, the Fund Manager ’s on-target compensation is about 10%+ of total

equity raised over a five-year projected hold period.

FUND OF FUNDS MADE EASY

Our goal is to make it as easy as possible to set up your fund and administer it, so that you can focus on raising capital and serving your investors.

Ready to Scale Your Capital Raising?

Partner with Nighthawk Equity and transform your capital raising approach. Book a call below to secure your future with a trusted leader in multifamily investments.

FAQs

What makes Nighthawk Equity different from other companies?

Our comprehensive services, proven track record, and SEC-compliant structure set us apart, making fund management seamless and secure.

How does the Fund of Funds structure benefit fund managers?

It allows fund managers more control over compensation and provides a secure framework to raise and manage capital.

What services are included in the "done for you" setup?

We cover legal formation, investor registration, fund administration, marketing support, tax services, and more.

(C) Copyright | All Rights Reserved | 2024 Nighthawk Equity